The key investment areas of the IT/Energo Fund include

IT-Energo (Fund I)

information and communication technologies,

low-emission energy, automation processes etc.

The main branches of investment

Low-emission energy

Bioenergy, photonics, nano-electronics, clean fossil technologies,

power generation, intelligent energy systems, renewable energy.

IT and Automation:

Mechatronics, intelligent buildings, control systems,

industrial automation, mobile applications, software.

Investment criteria

1. Project innovativeness

The project concerns technological (product and process) innovation.

2. Industry profile of the Fund

The project complies with the industry profile of the Fund (the areas of Smart Specialization of the Lubelskie Voivodeship).

3. Company headquarters

The entrepreneur has or intends to establish a seat in the Lublin voivodeship.

4. Definition of an enterprise

The enterprise meets the definition of an SME in accordance with Regulation 651/2014, is unlisted, has been operating for no more than 3 years and meets at least one of the following conditions:

- is not active on any market (has not made the first commercial sale on any market within the meaning of point 52 (xi) of the Union Guidelines on State aid for the promotion of risk finance investments (OJ EU of 22.01.2014 C 19/4) ));

- has not yet distributed the profits.

5. Exclusions

The entrepreneur is not in a difficult situation within the meaning of point 20 of the Guidelines on state aid for rescuing and restructuring non-financial enterprises in difficulty (Journal of Laws UE C 249/1 of 31.07.2014).

The entrepreneur is not obliged to return the aid, resulting from the decision of the European Commission declaring the aid illegal and with the common market or a judgment of a national or EU court.

An entrepreneur is not subject to exclusion from the possibility of access to public funds on the basis of legal provisions or exclusion of persons authorized to represent it.

Are you looking for an investor?

The entrepreneur is not in a difficult situation within the meaning of point 20 of the Guidelines on state aid for rescuing and restructuring non-financial enterprises in difficulty (Journal of Laws UE C 249/1 of 31.07.2014).

The entrepreneur is not obliged to return the aid, resulting from the decision of the European Commission declaring the aid illegal and with the common market or a judgment of a national or EU court.

An entrepreneur is not subject to exclusion from the possibility of access to public funds on the basis of legal provisions or exclusion of persons authorized to represent it.

What we offer?

Mentoring

Business Development

Networking

EU funds for development

How do we choose Startups?

1. Comprehensive target market

2. Strong IP (intellectual property)

3. Technology that creates added value

4. A durable and convincing business model

5. A clear path for introducing the product / process to the market

6. Clear divestment opportunities

7. Experienced project team

8. The chances of the project to obtain external funds for further development Investment process (2-6 months)

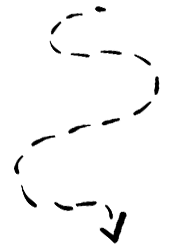

Investment process (2-6 months)

Detailed analysis of the project (including development of business documentation, mid-term selection).

Przeprowadzenie due diligence (finansowego, technologicznego i prawnego) oraz propozycja umowy inwestycyjnej (Term Sheet).

Conducting due diligence (financial and legal)

Investment decision to conclude an Investment Agreement

Recapitalization of the company (acquisition of shares).

Fund parameters

Fund Capitalization

(no option right)

Value and number of investments

The period of investment and divestment

PLN 30 million

Fund I

PLN 30 million

Fund II

max PLN 1.5 million

investment ticket

40 projects

2 x 20

Four years

(investments)

10 years

(divestments)

The Lublin Province Capital Fund was established under the Operating Agreements No. 4 / RPLU / 1518/2018 / I / DIF / 124 and No. 4 / RPLU / 1518/2018 / I / DIF / 125 Financial Instrument – Capital Entry concluded on 13/09/2018. between the Financial Intermediary (Netrix Ventures Sp. z oo) and the Fund of Funds Manager (Bank Gospodarstwa Krajowego, which under the Financing Agreement * acts as the Fund of Funds Manager in the Lublin Province). The Lublin Capital Fund invests in innovative projects at an early stage of development, especially before the first commercial sale, in line with the Smart Specialization of the Lublin Province *